Typically, large businesses use the direct method.

Per the indirect method, you start with your net income and make changes in order to see how much cash you have on hand. Small and medium-sized businesses tend to favor the indirect method, as it’s pretty simple. Generally speaking, there are two methods to generating the cash flow statement – the direct and indirect methods. the indirect method for generating cash flow statements While a budget is used to plan for spending or projects, the cash flow forecast is mainly utilized to manage cash tightly or to protect against overdraft.Ī daily cash flow report template can look something like this: Direct vs. On the other hand, a cash flow forecast shows the expected cash coming in and out, and it usually divides transactions into monthly columns. It doesn’t reflect bank or cash movement separately. Typically, a budget is shown for an entire year, or an otherwise specific period, and reflects all relevant income and expenditure for that period of time. cash flow report – what’s the difference? Poor financial planning – If you don’t set up your budget beforehand and don’t perform a cash flow forecast, you’re likely to find yourself dealing with cash shortages.īudget report vs.Expanding too fast – Expanding a business too fast can put a business in crisis mode.Over investment – If a business spends too much money on non-business things, it’ll only drain funds and result in insufficient cash funds.If a business is not profitable, it won’t have enough money to cover outgoings. Low profits – Profits are a major source of cash, usually coming in from customer payments of the selling of assets.What can be the reason behind poor cash flow? Senior management may request a monthly report that includes a month-end cash forecast so that they can get a good understanding of the health of the company’s liquidity reserves over time. Oftentimes, the goal of a monthly cash flow forecast is management reporting focused. When used appropriately, an organization can improve liquidity analysis in addition to reducing the chances that the organization will unexpectedly run into a cash crunch. Typical users of the cash flow report are CFOs, controllers, and accountants. Organizations rely on monthly cash flow statements to closely monitor cash inflows and outflows. The primary aim of the monthly cash flow report is to present an o verview of the financial activity experienced throughout the month. What’s the purpose of a monthly cash flow report? A negative cash flow, on the other hand, results when the outflow of cash is greater than the incoming flow of cash. A positive cash flow occurs when the cash that enters your business, whether it be from sales, AR, or anything else, is greater than the amount of cash that leaves your business through AP, salaries, or any other expense. Ultimately, there are two kinds of cash flow results – a positive cash flow or a negative cash flow. Cash Flow Forecast = Beginning Cash + Projected Inflows – Projected Outflows = Ending Cash.Operating Cash Flow = Operating Income + Depreciation – Taxes + Change in Working Capital.

#Purpose of statement of cashflows free

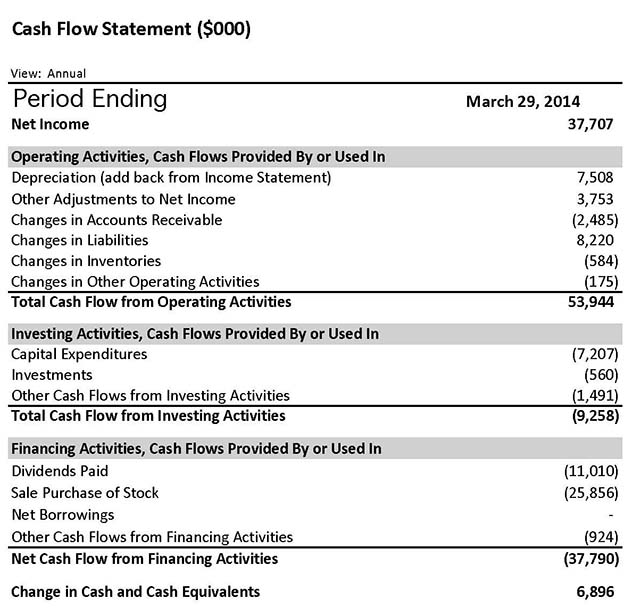

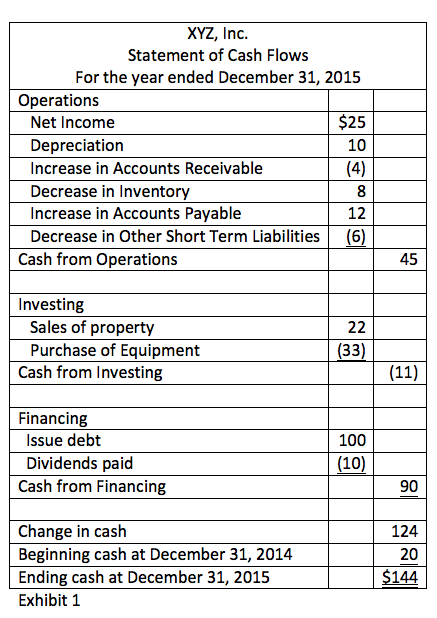

Free Cash Flow = Net income + Depreciation/Amortization – Change in Working Capital – Capital Expenditure.Payment of dividends, payments for stock repurchases, and the repayment of debt principal (loans) are also included. Sources of cash from investors or banks, as well as the uses of cash paid to shareholders. So, any changes in assets, equipment, or investments that relate to cash from investing.Ī. This includes any payment that was made in relation to a merger or acquisition, or a purchase or sale of an asset. Any sources and uses of cash from a company’s investments. This includes receipts from sales of goods and services, interest payments, income tax payments, payments made to suppliers of goods and services used in production, salary and wage payments to employees, rent payments, and any other type of operating expensesĪ. The three sections of the cash flow statement are:Ī. Observe what impact cash flow has on the business.Consider how funds are moving throughout the organization.The cash flow statement aims to look at how cash is moving in and out of the business. Alongside the balance sheet and income statement, the cash flow statement is a mandatory component of an organization’s financial reports. The cash flow statement (CFS), also known as a cash flow report, is a financial statement that sums up the amount of cash that enters and leaves an organization.

0 kommentar(er)

0 kommentar(er)